The Fragile Edifice: AI Debt and Its Systemic Implications

Introduction: Between Triumph and Vulnerability

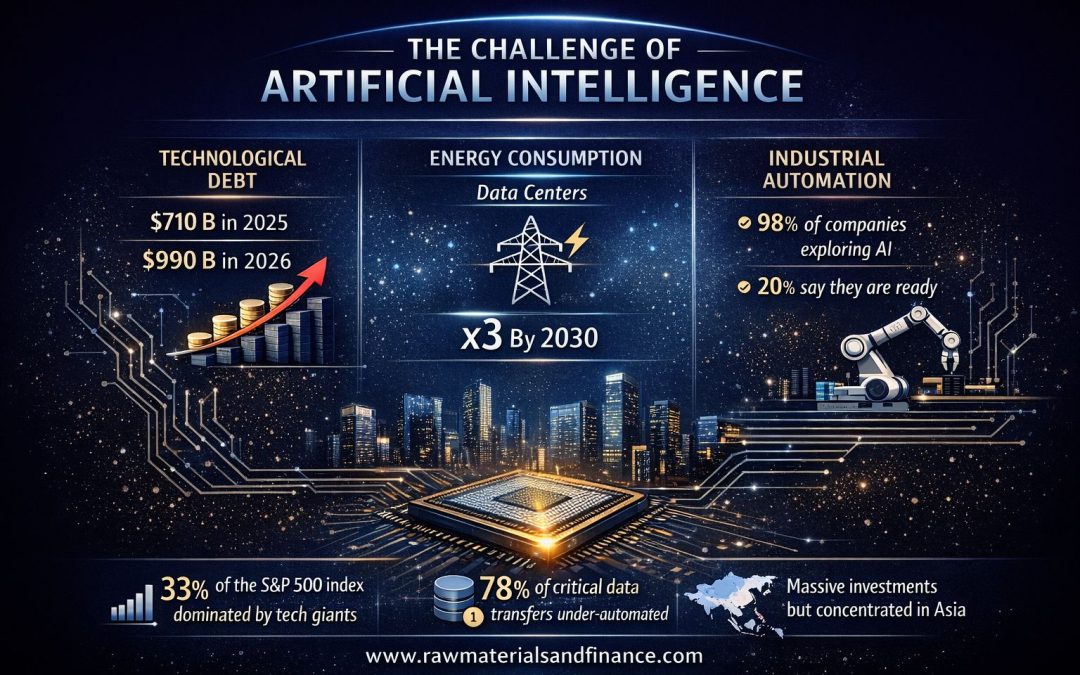

The artificial intelligence revolution is often depicted as an unstoppable, linear triumph. Yet behind the media narrative, financial, energy, and industrial data from early 2026 reveal unprecedented fragilities. Massive debt accumulation, concentrated actors, energy constraints, and fragmented industrial processes paint a complex picture in which technological promises clash with tangible realities.

Decision-makers must recognize that AI does not evolve in a vacuum. The data show that the pace of technological innovation is coupled with intense financial and operational pressures, posing systemic risks if not accompanied by regulation and strategic planning.

Part 1: The Unprecedented Scale of Debt Financing

1.1 Vertiginous Figures and Debt Trajectories

The technology debt market is exploding. According to UBS, cited by CNBC in February 2026, AI-related and tech debt issuance reached $710 billion in 2025 and could approach $990 billion in 2026. Morgan Stanley highlights a $1.5 trillion financing gap for AI infrastructure, largely to be covered by credit.

This growing reliance on debt transforms innovation funding into a potentially unstable lever. Should market conditions tighten, the fragility of this financial edifice could quickly ripple across other sectors.

1.2 Hyperscalers’ Financing Strategies

- Oracle plans to raise $45-50 billion for AI capacity, with $25 billion already issued in the high-grade market.

- Alphabet increased bond issuance to over $30 billion, including record euro-denominated “Reverse Yankee” bonds.

- Amazon filed a mixed registration to raise both debt and equity.

- Meta and Tesla signal cautious external financing to support infrastructure.

The speed and scale of these issuances reveal a corporate appetite for leverage while exposing investors to latent volatility. Debt concentration among a few major actors increases systemic risk.

1.3 Investor Appetite and Early Warnings

Alphabet’s bonds were five times oversubscribed, with yields near three-year Treasury levels. Chris White (BondCliQ) describes a monumental corporate debt supply, while John Lloyd (Janus Henderson Investors) notes historically tight spreads.

Investor euphoria reflects a risk underestimation. Immediate liquidity does not guarantee future resilience.

Part 2: Identified Structural Fragilities

2.1 Excessive Market Concentration

A third of the S&P 500 comes from trillion-dollar tech companies, including Nvidia and hyperscalers. Technology now represents 9% of investment-grade indices, with potential growth to 15-19%.

High concentration makes markets vulnerable to shocks affecting a small number of actors. Diversification, financial and industrial, is a strategic imperative.

2.2 Energy: The Ignored Limiting Factor

| Year | US Data Center Electricity (TWh), IEA |

| 2021 | 120.65 |

| 2022 | 134.07 |

| 2023 | 154.07 |

| 2024 | 182.61 |

| 2025 | >200 (proj.) |

| 2026 | 250 (proj.) |

| 2030 | >400 (proj.) |

S&P Global Energy confirms 17% annual growth by 2026, then 14% per year through 2030. The US and China account for ~80% of global growth.

Energy demand may become a bottleneck for AI deployment, with implications for industrial policy and climate objectives.

2.3 The Industrial Automation Paradox

Redwood Software reports 98% of industrial firms exploring AI, but only 20% feel fully ready. 78% automate less than half of critical data transfers.

Fragmented automation limits AI reliability. Investments must include data orchestration, not just raw technology.

2.4 Concentration in Asia

AI investments in Asia exceed those in the US and Europe. PwC forecasts a 8.8% CAGR for global semiconductor demand 2024-2030, yet reliance on debt and market concentration raises systemic vulnerability.

Asia’s industrial strength is an asset, but financial fragility and sector concentration require proactive monitoring.

Part 3: Scenarios and Systemic Risks

3.1 Contagion on Bond Markets

Chris White warns that massive hyperscaler debt could pressure yields across other issuers, raising capital costs and reducing profits.

Policymakers must anticipate potential contagion and implement financial resilience mechanisms.

3.2 Valuation Corrections

Schroders notes that a mere 10-15 bps widening of spreads could underperform government bonds.

Even minor shocks could materially reprice tech assets, emphasizing the need for stress-test scenarios.

3.3 Supply Chains

Semiconductor concentration (Taiwan, South Korea) exposes AI infrastructure to geopolitical and natural risks. Automation alone cannot compensate.

Industrial resilience requires geographic diversification and proactive flow management.

Part 4: Sectoral Impacts

4.1 Financial Markets

- Bond funds saw net inflows in 2025 but remain highly rate-sensitive.

- Schroders remains positive but monitors concentration and valuations.

High correlation between major firms and bond markets could amplify shocks.

4.2 Commodities

- Gold remains a safe-haven asset, supported by central banks and private demand in China.

- Industrial metals are under pressure due to AI infrastructure demand.

Analytical reflection: Supply and storage strategies for critical metals become an economic and technological security factor.

4.3 Human Resources and Skills

- 40% of automation teams feel unprepared.

- Orchestration platforms (SOAP) are critical to bridge the skills gap.

AI amplifies capabilities; without targeted training, ROI is limited and operational risks rise.

4.4 Industry and Construction

- Automation reduces unplanned downtime ≥26% but exception management ≤40%.

Industrial success depends on intelligent workflow integration and governance, not just technology.

4.5 Technology and Semiconductors

- Semiconductor demand CAGR 8.8% (2024-2030).

- Increasing concentration and debt pose documented systemic risk.

Asian tech growth is global, but financial and strategic sustainability must be assessed.

Part 5: Pathways for Shared Progress

- Financial transparency: monitor off-bank circuits.

- Energy planning: align infrastructure with renewable surpluses.

- Orchestration over accumulation: adopt SOAP platforms.

- Skills and training: close competence gaps.

- Geographic diversification: reduce single-chain dependency.

- Operational AI governance: integrate into workflows.

- Performance reorientation: focus on resilience and protection of critical flows.

These measures are non-optional. AI is now a strategic vector; ignoring them heightens risk of wealth and market concentration.

Conclusion: A Moment of Decision

- AI debt 2025: $710B; 2026: $990B

- Data center electricity consumption triples by 2030

- 98% of industrial firms explore AI, 20% ready; 78% of critical data transfers insufficient

- Asian investments massive but concentrated and debt-financed

The story of AI will be written by strategic choices today. Informed decision-makers must integrate financial, industrial, and human realities to ensure the AI revolution becomes a common good rather than a lever of wealth concentration.

Sources

- UBS, Global Tech Debt Forecast 2026, February 2026 (via CNBC)

- Morgan Stanley, Tech Infrastructure Financing Gap, January 2026

- Schroders, Credit Lens Dec 2025, Credit Lens Jan 2026, Asia Multi-Asset Outlook 2026

- Redwood Software, Manufacturing AI and Automation Outlook 2026, January 2026

- IEA, Energy and AI, November 2025

- S&P Global Energy, Horizons Top Trends 2026, December 2025

- PwC, Semiconductor Industry Outlook 2024-2030

Important Disclaimer: The content of this article is provided for informational and educational purposes only. It reflects the author’s opinion based on information available at the time of publication, which may become outdated. This content does not constitute personalized investment advice, a recommendation to buy or sell, and does not guarantee future performance. Markets carry a risk of capital loss. The investor is solely responsible for their decisions and should consult an independent professional advisor before any transaction. The publisher disclaims all liability for decisions made based on this information.