10/03/2026

MARCH 2026 GLOBAL ECONOMIC OUTLOOK

A world economy holding together under structural pressure

Introduction: Stability under strain

March 2026 confirms that the global economy has entered a phase best described as constrained stability. Growth has not collapsed, inflation has moderated, and employment remains relatively resilient across most advanced economies. Yet the system operates with significantly narrower margins of safety than in the previous decade.

According to the International Monetary Fund’s World Economic Outlook Update (January 2026), global GDP is expected to expand by roughly 3.3% in 2026, broadly in line with the estimated growth rate for 2025. This suggests that the world economy remains resilient, but also that it has settled into a lower-speed equilibrium shaped by higher financing costs, geopolitical uncertainty and structural transitions in energy and technology.

Disinflation has continued but remains incomplete. According to Eurostat, inflation in the euro area stood at approximately 1.9% in February 2026, close to the European Central Bank’s target but still subject to volatility from energy and food markets. In the United States, according to the Bureau of Labor Statistics, the unemployment rate reached about 4.4% in February 2026, indicating a labor market that remains healthy but gradually less tight than during the peak of the post-pandemic expansion.

In this context, the central economic question has shifted. The issue is no longer whether the global economy can grow, but how resilient that growth remains in the face of recurrent shocks.

1. Financial markets: diversification and selective risk

Equities and ETF markets

Global capital markets continue to expand in scale but have become more selective in allocation. According to ETFGI, global assets invested in exchange-traded funds and exchange-traded products reached approximately $20.6 trillion by January 2026, reflecting sustained investor demand for liquid, diversified investment vehicles in a volatile macroeconomic environment.

However, capital flows reveal increasing sectoral differentiation. Technology, digital infrastructure and artificial intelligence continue to attract strong inflows, while capital-intensive industries remain more sensitive to elevated financing costs.

Sustainable finance also remains structurally important. According to ETFGI, ESG-focused ETFs accounted for nearly $800 billion in global assets by the end of 2025, demonstrating that environmental and governance criteria remain embedded in institutional investment strategies, even as regulatory frameworks become more pragmatic.

Crypto assets: a volatile but persistent financial segment

Digital assets remain a visible but volatile component of the global financial ecosystem. According to market data reported by Reuters in early 2026, Bitcoin traded around $68,000, following a period of correction linked to rising risk aversion and macroeconomic uncertainty.

Regulators continue to monitor the sector closely. According to a Federal Reserve research note published in December 2025, the expansion of stablecoins could influence deposit flows within the banking system and alter the channels of financial intermediation. This suggests that crypto markets are no longer viewed solely as speculative instruments but increasingly as elements of the broader financial architecture.

2. Commodities: strategic markets in an uncertain environment

Agriculture and global food markets

Agricultural markets have regained strategic importance for both policymakers and investors. According to the Food and Agriculture Organization of the United Nations (FAO), the FAO Food Price Index reached approximately 125 points in February 2026, rising slightly after several months of decline.

According to the FAO, the increase was driven primarily by higher prices for cereals, vegetable oils and meat products, reflecting climatic disturbances and logistical disruptions affecting major exporting regions.

These developments highlight a structural reality: food markets are no longer only an inflation component; they are increasingly a dimension of economic and geopolitical stability.

Industrial and precious metals

Industrial metals remain central to the global energy transition. According to the International Energy Agency (IEA), demand for critical minerals such as copper, lithium and nickel continues to expand as investments accelerate in renewable energy infrastructure, electrification and battery technologies.

At the same time, precious metals continue to serve as financial hedges against uncertainty. According to market reports cited by Reuters, gold reached historically high levels in early 2026 before stabilizing as the U.S. dollar strengthened and interest-rate expectations adjusted.

This dual movement illustrates the evolving role of commodities: industrial metals reflect structural transformation, while precious metals reflect systemic risk perception.

3. Energy markets: transition and security

Energy markets remain shaped by the interaction between the energy transition and supply security concerns.

According to the International Energy Agency’s Oil Market Report, global oil demand is expected to increase by roughly 850,000 barrels per day in 2026, while global supply could reach approximately 108.6 million barrels per day. Under normal conditions, such figures would suggest a relatively balanced market.

However, geopolitical developments continue to influence price dynamics. According to analyses reported by Reuters in March 2026, tensions in the Middle East temporarily pushed oil prices higher, demonstrating how quickly geopolitical risk can translate into inflationary pressure.

Meanwhile, renewable energy continues to expand rapidly. According to the IEA’s Renewables Market Report, global renewable electricity generation could reach approximately 16,200 TWh by 2030, compared with about 9,900 TWh in 2024, indicating a structural transformation of the global energy system.

4. Semiconductors: the backbone of the digital economy

Few sectors illustrate the transformation of the global economy more clearly than semiconductors.

According to World Semiconductor Trade Statistics (WSTS), the global semiconductor market reached approximately $796 billion in 2025, and could approach $975 billion in 2026, driven by demand linked to artificial intelligence, cloud computing and digital infrastructure.

This growth reflects more than a traditional technology cycle. Semiconductor supply chains now represent a strategic asset for industrial competitiveness and technological sovereignty, making the sector central to economic policy in the United States, Europe and Asia.

5. Logistics and global trade

Logistics has become a strategic variable of economic performance.

According to the United Nations Conference on Trade and Development (UNCTAD) in its Review of Maritime Transport 2025, global maritime trade grew by roughly 0.5% in 2025, while containerized trade expanded by about 1.4%.

For the period 2026-2030, UNCTAD projects average annual growth of approximately 2% for total maritime trade and 2.3% for containerized shipping, suggesting moderate but sustained expansion.

At the same time, logistics costs remain sensitive to geopolitical disruptions. According to Drewry Shipping Consultants, the World Container Index stood at roughly $1,950 per forty-foot container in early March 2026, reflecting renewed volatility in freight markets.

6. ESG policy developments

Environmental, social and governance policies continue to shape the regulatory environment for businesses and investors.

In Europe, according to decisions adopted by the Council of the European Union in February 2026, the implementation of the Corporate Sustainability Reporting Directive (CSRD) and the Corporate Sustainability Due Diligence Directive (CSDDD) has been accompanied by regulatory simplification measures aimed at reducing administrative burdens while maintaining transparency requirements.

These developments suggest that ESG policies are entering a phase of institutional consolidation, moving beyond initial expansion toward more operational and economically integrated frameworks.

Conclusion: the rise of resilience economics

The economic landscape of March 2026 is not defined by collapse or exuberance, but by structural tension. The global economy continues to grow, yet the forces shaping that growth (energy security, technological transformation, geopolitical risk and climate transition) are increasingly interconnected.

For policymakers and investors alike, the implication is clear. The next phase of economic performance will not be determined solely by growth rates but by the capacity of systems to remain resilient under pressure.

In such an environment, the most strategic sectors are those that underpin the functioning of the global economy itself: energy systems, semiconductor supply chains, agricultural resilience, logistics infrastructure and reliable data ecosystems.

In a world where shocks travel faster than policy responses, resilience has become the most valuable economic asset.

Sources

International Economic Institutions

International Monetary Fund (IMF), World Economic Outlook Update, January 2026

World Bank, Commodity Markets Outlook, October 2025 and 2026 updates

World Trade Organization (WTO), Global Trade Outlook and Statistics

Bank for International Settlements (BIS), Annual Economic Report and BIS Working Papers

Central Banks and Monetary Authorities

European Central Bank (ECB), Economic Bulletin, monetary policy decisions and macroeconomic projections

Federal Reserve System (United States), FOMC Statements and Summary of Economic Projections

Bank of Japan, Monetary policy statements and economic outlook reports

Official Statistical Agencies

Eurostat, Harmonised Index of Consumer Prices (HICP), GDP and economic statistics for the euro area

U.S. Bureau of Labor Statistics (BLS), Employment Situation Reports

U.S. Census Bureau, international trade and economic statistics

National Bureau of Statistics of China (NBS), PMI indicators, CPI/PPI inflation and industrial production

Ministry of Statistics and Programme Implementation (MOSPI – India), national economic statistics and macroeconomic data

International Sectoral Organizations

Food and Agriculture Organization of the United Nations (FAO), FAO Food Price Index

International Energy Agency (IEA), Oil Market Report, World Energy Outlook, Renewables Market Report

World Semiconductor Trade Statistics (WSTS), global semiconductor market forecasts and industry statistics

U.S. Geological Survey (USGS), Mineral Commodity Summaries

Climate Bonds Initiative, data on sustainable finance and global green bond markets

Logistics and Global Trade

United Nations Conference on Trade and Development (UNCTAD), Review of Maritime Transport 2025

Drewry Shipping Consultants, World Container Index

Financial Market Data

Bloomberg Terminal, financial markets and commodities data

Refinitiv Eikon (LSEG), financial data, analytics and market intelligence

London Metal Exchange (LME), industrial metals prices and market data

Intercontinental Exchange (ICE), energy markets and derivatives trading data

Asset Management and ETF Industry

ETFGI, ETF Global Insights, global ETF and ETP industry statistics

Research Institutes and Analytical Centers

Stanford University, AI Index Report, global data on artificial intelligence development and investment

Potsdam Institute for Climate Impact Research (PIK), climate and economic impact research

McKinsey Global Institute (MGI), research on global productivity, economic transformation and value chains

The Conference Board, productivity statistics and economic indicators

International Economic News Agencies

Reuters

Bloomberg News

Agence France-Presse (AFP)

Important Disclaimer: The content of this article is provided for informational and educational purposes only. It reflects the author’s opinion based on information available at the time of publication, which may become outdated. This content does not constitute personalized investment advice, a recommendation to buy or sell, and does not guarantee future performance. Markets carry a risk of capital loss. The investor is solely responsible for their decisions and should consult an independent professional advisor before any transaction. The publisher disclaims all liability for decisions made based on this information.

MARCH 2026 GLOBAL ECONOMIC OUTLOOK

A world economy holding together under structural pressure Introduction: Stability under strain March 2026 confirms that the global economy has entered a phase best described as constrained stability. Growth has not collapsed, inflation has moderated, and employment...

WHAT THE NUMBERS ACTUALLY TELL US ABOUT WOMEN’S PLACE IN THE WORLD, “WOMEN FOR SUSTAINABLE WORLD” PROJECT

As major financial institutions call for a global mobilisation for economic equality, the most recent data reveal a dizzying gap between proclaimed rights and the lived reality of billions of women. An investigation into a structural injustice that costs the planet...

WEALTH-BASED SEGREGATION: WHEN CAPITAL BECOMES THE BOUNDARY OF DESTINY, “WOMEN FOR SUSTAINABLE WORLD” PROJECT

1. The Invisible Frontiers of Power There exist borders that no customs officer guards and no treaty mentions. They do not separate territories, but destinies. They are neither geographical nor cultural in nature. They are patrimonial. At the heart of this invisible...

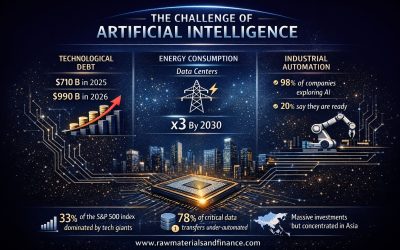

The Fragile Edifice: AI Debt and Its Systemic Implications

The Fragile Edifice: AI Debt and Its Systemic Implications Introduction: Between Triumph and Vulnerability The artificial intelligence revolution is often depicted as an unstoppable, linear triumph. Yet behind the media narrative, financial, energy, and industrial...

Market Outlook, Week of February 16, 2026

Executive Overview Global financial markets enter mid-February in a phase characterised by relative stability in policy expectations, selective equity leadership, and persistent geopolitical sensitivity. Cross-asset signals suggest neither systemic stress nor...

ESG at the Crossroads: Between Public Promise and Private Power

In the early years of the decade, ESG (Environmental, Social and Governance) carried the tone of a moral awakening. Capital, long accused of indifference to social and ecological cost, appeared ready to reform itself. Sustainability was no longer the vocabulary of...

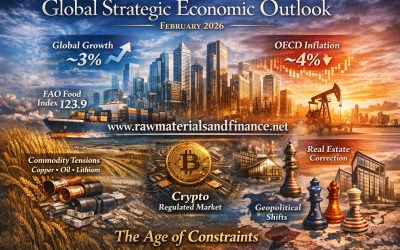

February 2026 Economic Outlook

Preamble: A global economy entering the age of conscious constraints The global economy in early 2026 is neither recovering nor booming. It is lucid.The great cycles of economic illusion like monetary abundance, frictionless globalization, cheap energy, geopolitically...

Global and European Markets, Week of 19 January 2026

Surface stability, underlying tensions As markets enter the week of 19 January 2026, a semblance of calm dominates. Systemic stress indicators remain contained, implied volatility is moderate, and major indices are confined to narrow trading ranges. Yet beneath this...

The EU-Mercosur Agreement: European Economic Balance, Regional Spillovers, Risks, Opportunities and Long-Term Outlook

After more than twenty-five years of negotiations, the trade agreement between the European Union and the Mercosur bloc comprising Brazil, Argentina, Paraguay and Uruguay, stands as one of the most consequential trade initiatives in modern EU commercial policy. As the...

Market Outlook, Week of January 12, 2026

1. Global Macroeconomic Context: An Economy in Transition United States: A Softening Labour Market Amid Persistent Inflation The U.S. economy enters 2026 against a backdrop of a visibly weakening labour market following a pronounced slowdown at the end of last year....

EUROPE UNDER STRAIN: GEOPOLITICS, ECONOMIC PERFORMANCE, AND THE PRESERVATION OF PSYCHIC CAPITAL, “WOMEN FOR SUSTAINABLE WORLD” PROJECT

Prologue: The Contemporary European Paradox The European Union is currently facing a profound structural tension. On the one hand, it claims a socio-economic model grounded in the protection of human dignity, social cohesion, and quality of working life. On the other,...

JANUARY 2026 ECONOMIC OUTLOOK

FOREWORD: THE ERA OF COMPLEX SYSTEMS We are now navigating a global economy in which traditional analytical categories are reaching their limits. This outlook synthesizes three complementary levels of analysis: market dynamics (trading data and financial flows),...

Market Outlook: Week of 29 December 2025, A Year-End Data Validation

As 2025 draws to a close, markets are navigating a period of extremely low technical liquidity, amplifying any potential surprise. This week is not about major directional moves, but rather the consolidation of year-end trends as investors prepare their...

2025: WHEN THE GLOBAL ECONOMIC SYSTEM WEAKENS THE MOST VULNERABLE, “WOMEN FOR SUSTAINABLE WORLD” PROJECT

At the end of 2025, major macroeconomic aggregates present a paradoxical picture: global unemployment rates remain relatively low, and labor markets are recovering in many countries. Yet deep fractures are widening between social groups, particularly among those...

2025: The Year Markets Stopped Pretending

Year-end Chronicle : A European and Global Perspective There are years that merely extend cycles, and others that expose them. 2025 did not overturn the global economic order; it revealed its fatigue, its fault lines, and its blind spots. Beneath the apparent...

Global Market Outlook: Week of 15 December 2025 (The Ultimate Liquidity Stress Test)

As 2025 enters its final act, global markets approach a decisive inflection point: the transition to a structurally tighter liquidity environment. The week of 15 December serves as a crucial barometer of the market's capacity to digest this new paradigm, coinciding...

Tariff Wars, from Yesterday to Tomorrow

A Historical Anatomy Renewed by Modern Research The historical analysis of trade conflicts, long focused on macroeconomic causes, now benefits from multidisciplinary approaches. The work of economist Davin Chor (National Bureau of Economic Research, 2023)...

High-Altitude Wind Power: Unlocking an Untapped Layer of the Energy Transition

At a time when energy systems face unprecedented pressure to deliver resilience, flexibility, and cost-competitiveness, a new frontier is emerging several hundred metres above ground. High-altitude wind power (HAWP), the generation of electricity using tethered flying...

Market Outlook: Week of December 8, 2025

At a Glance Equities & Bonds: Markets on edge ahead of key U.S. monetary policy decisions and next week's inflation indicators. Heightened volatility expected in bonds. Rates / Central Banks: Final significant week before the Fed's "blackout period."...

“TODAY’S SLAVERY”: A SOCIO-ECONOMIC REALITY HIDDEN IN PLAIN SIGHT “WOMEN FOR SUSYAINABLE WORLD” PROJECT

Modern slavery is not a metaphor; it is a statistical and economic reality that today exceeds, in scale and structure, the slavery of previous eras. What once relied on chains, markets and physical ownership now takes the form of fragmented supply chains, digital...

When Globalisation Cracks: How Economic Fragmentation Is Reshaping Prices, Trade and Supply Security

Across policy circles and boardrooms, one word has quietly become unavoidable: fragmentation. No longer a theoretical concern, it has taken shape in the form of desynchronised supply chains, highly targeted trade restrictions, and a global race to onshore critical...

Critical Week for Markets: Tensions, Transitions, and Opportunities on December 1, 2025

Global Context : Markets & Macro Climate The week in Europe opens under a cautious mood: major European stock markets are expected to decline on Monday, awaiting numerous macroeconomic releases, notably manufacturing activity in the eurozone. On the energy and...

Global Energy Markets and Geopolitics: A New and Uneasy Equilibrium

Energy markets in late-2025 move like a constellation pulled by several gravitational forces at once: geopolitics, supply chains, climate imperatives, and shifting centres of economic growth. What emerges is not chaos, but a new and still fragile equilibrium that...

Market Outlook for The Week of 24 November 2025

At a Glance Equities: Caution prevails as sector rotation drives volatility (AI vs. defensive plays). Rates / Central Banks: The ECB remains on hold; investors remain vigilant on rate trajectories and credit conditions across the eurozone. Energy (Oil): Brent trading...

“TODAY’S FRANKENSTEINS”: WHEN THE PET MARKET BECOMES A RAW MATERIAL

Behind the tenderness, the wellness rhetoric and the Instagram reels lies a far more powerful engine: a rapidly expanding market built on premium nutrition, insurance, veterinary services, lifestyle branding, and more controversially, genetic selection and aesthetic...

Global Agricultural Commodities in November 2025

Abundance on Paper, Scarcity in the Data Layer 1. Record stocks, soft prices and nervous farmers As November 2025 draws to a close, the global agricultural landscape looks deceptively comfortable. On the physical side, the world has rarely been better supplied with...

THE WORLD FACING THE MASSIVE COST OF FAMILY ABANDONMENT

"WOMEN FOR SUSTAINABLE WORLD" PROJECT In European economic debates, policymakers often focus on the energy transition, industrial competitiveness, or fiscal strategy. Yet a silent phenomenon has emerged as one of the deepest and least visible social fractures of our...

From Jet Fuel to Judgment Day: The True Cost of Flying in a Warming World

Singapore’s Green Gamble: Can a Tiny Nation Change How the World Flies? In a world still dazzled by the revival of international air travel and the resurgence of global hubs, the sovereign city-state of Singapore has quietly declared that it will levy the world’s...

Oil 2025: Oversupply Takes Centre-Stage, and the Real Impacts Are Elsewhere

As we move toward the end of 2025, the global oil market is settling into a pattern unlike the supply shocks of past cycles. The key story is oversupply, not a sudden disruption. And while the headline price of crude may seem limited in its dynamics, the ripple...

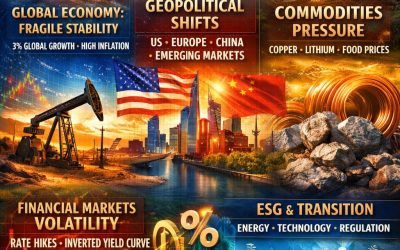

GLOBAL ECONOMIC & MARKETS OUTLOOK: NOVEMBER 2025 Beyond the Soft Landing is the Great Sectoral Divergence

EXECUTIVE SUMMARY The global economy is navigating a multi-speed reality where traditional indicators mask radical sectoral transformations. While headline growth appears stable at 3.0% (IMF), beneath the surface we witness the most significant capital...

MOTHERS IN THE AGE OF MACHINES: WHY THE FUTURE HANGS ON THE PRICE OF CARE

We live in a century that worships efficiency. Robots weld, algorithms predict, capital compounds in silence. Yet the arithmetic of humanity is going the other way: fewer cradles, more canes. Across continents, the question is no longer “how many jobs will machines...

Markets: The Trump-Xi Truce Offers a Fragile Breather for Global Investors

Between Tactical Relief and Structural Doubt, Global Finance Holds Its Breath After a turbulent week marked by falling U.S. indexes and a 1.57% drop in the Nasdaq, the meeting between Donald Trump and Xi Jinping in Busan, on the sidelines of the APEC summit, brought a...

Markets – Week Ahead

Between Cautious Breathing and Geopolitical Tension: European Markets at a Strategic Crossroads As a new trading week begins, European markets face a landscape of sharp contrasts: on one side, a global economy entering a phase of controlled slowdown; on the other, a...

THE INVISIBLE HUNGER

Dawn has not yet risen over Europe’s rooftops. In the half-light of her kitchen, a mother silently calculates the month ahead, staring at a cup of coffee she has no time to finish. In the next room, a child is still asleep, his school bag resting against the wall like...

Week Ahead (Oct 20-24, 2025): Markets at the Crossroads of Turbulence and Transformation

In the final quarter of 2025, the global economy drifts through an age of transition, not collapse, not exuberance, but the delicate middle ground of recalibration. The markets, once guided by narratives of expansion, now move according to quieter laws: risk,...

Global Trade Wars and the Steel Industry: Europe’s Hidden Fault Lines

Global Context In the autumn of 2025, the global industrial order stands at a crossroads between trade confrontation and ecological transition. Rivalries between the United States, China, and, increasingly, the European Union are reshaping economic balances. Steel,...

Europe’s Slow Burn: When Patience Becomes Alpha

The Case for Slowness in an Impatient World Europe isn’t roaring; it’s recalibrating. In a global market addicted to velocity, the European Union is quietly mastering the art of measured motion, a slow burn of stability in a world chasing instant gratification. While...

The Silent Empire: Financial Concentration at Europe’s Time of Crisis

Introduction Europe enters the autumn of 2025 under a cloud of uncertainty. Growth remains close to zero across several eurozone economies; inflation lingers despite restrictive monetary policy, and the long-promised industrial revival feels elusive. Beneath this...

Mothers and the Economy: Towards an Optimal Model

The way a society treats its mothers reveals its deepest truths. Where they are supported, trust circulates, children grow in stability, and economies find solid ground. Where they are neglected, everything begins to fracture: intergenerational poverty, declining...

Economic Outlook: October 2025

Global Outlook Global growth remains positive but constrained: the IMF forecasts 3.0% in 2025 and 3.1% in 2026, while the WTO expects a - 0.2% decline in merchandise trade in 2025, followed by a +2.5% rebound in 2026. Inflation is easing but uneven: 2.2% in the euro...